The amount of income generated by tourism depends not only on the price of a tourist trip or the wealth of tourists, but also on their tendency to repeat tourist trips throughout the year and on the time spent travelling. It should not be forgotten that there are two types of competition in the tourism market: internal and external. Internal competition is other tourist service providers with whom we compete directly for a given tourist/client: for an accommodation facility it is other accommodation facilities, for a tourist agency – other agencies, for a tourist region – other regions, and for Poland – any other country to which tourists may travel. Focusing on this type of competition, we often forget that there is also external competition. An average Polish family of 2+2 with an average income, which can plan two holidays in a year (e.g. one two-week stay at the seaside in summertime and one-week long skiing trip to the mountains) can be ‘taken for granted’, unless it turns out that in a given year they are forced to incur extraordinary expenses and give up one or both trips. This extraordinary expense can be, for example, the necessity to finance an expensive operation for one of the family members, a decision to renovate the flat, or a large expense related to the purchase of a car or a home cinema system. Probably no travel agency owner even considers the fact that they are actually competing for clients with a private hospital, car dealer, or renovation company.

Therefore, one of the most important categories from the point of view of the tourism industry is the inclination of Poles to go on tourist trips. The more the habit of travelling is established socially, and preferably several times a year, the greater the chance that potential tourists will put off the idea of refurbishing or buying new kitchen furniture so as not to leave out a holiday trip. Most studies show that we have become so accustomed to tourism that it is difficult to give up the idea of a holiday. We have therefore included this theme in our Qtravel research as one of the most important.

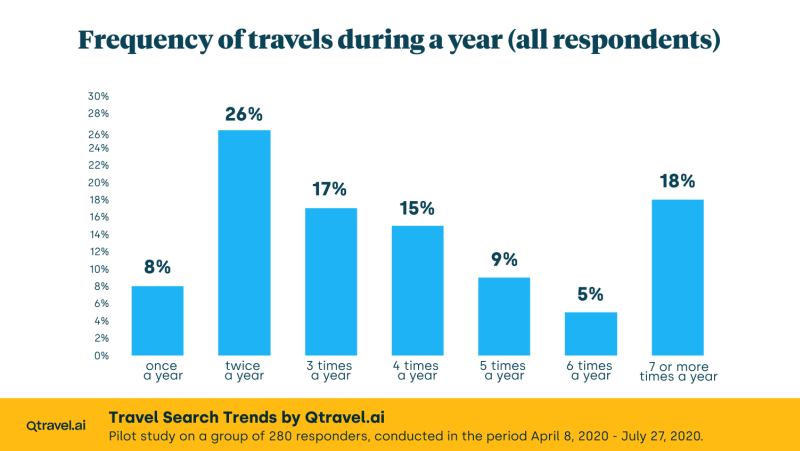

The presented chart (Figure 1) shows that although the highest (26%) percentage of people undertakes tourist trips twice a year, a significant part of respondents (18%) undertakes more than seven tourist trips a year, which reflects the growing inclination of Poles to undertake weekend trips (including during the so-called ‘long weekends’, e.g. at the beginning of May). A similar percentage of respondents (17% and 15%) takes 3 or 4 trips a year respectively.

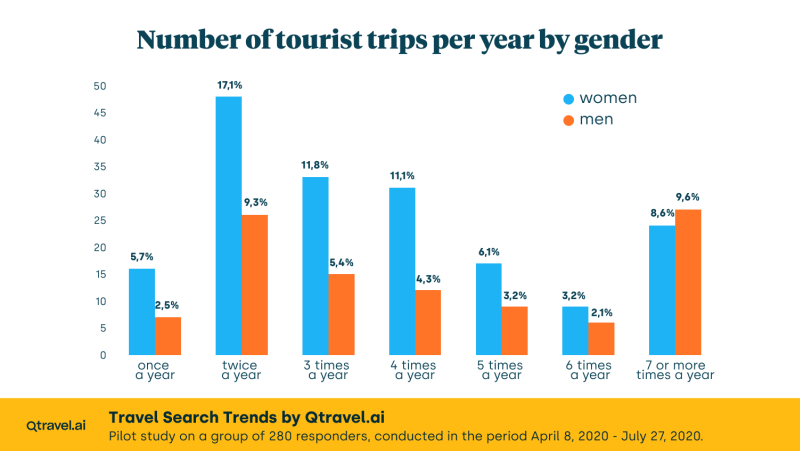

The number of travels a year in the group of women and men is slightly different (Figure 2). Women most often (48%) declared that they travelled twice a year, and slightly less often that they travelled 3 and 4 times a year (33% and 31% respectively). A significant group (24%) of women also declared that they travelled 7 times or more per year. In the latter case, the percentage of men was similar (27%), who equally often (25%) declared making 2 trips a year. Only 2.5% of men declared taking a tourist trip only once a year.

And what is the correlation between earnings and the frequency of trips?

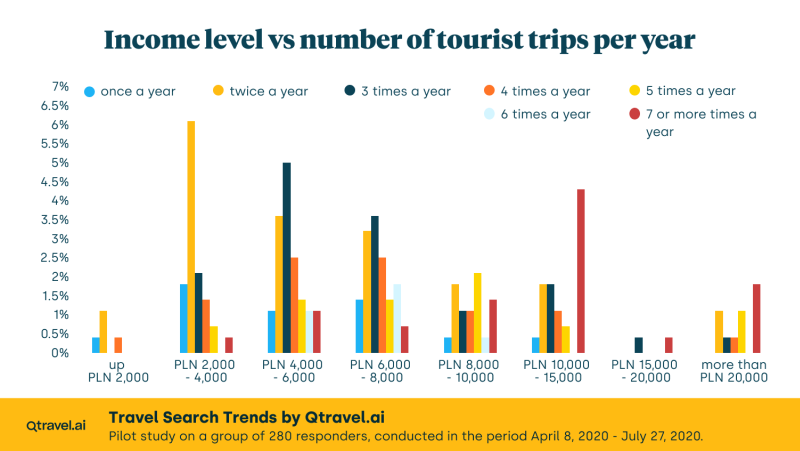

In the lowest income group (up to PLN 2,000), two trips per year predominated, although declarations of one trip or four trips per year (see Figure 3) were also found.

The option of two trips per year was also dominant in the income bracket of PLN 2,000–4,000, but in the brackets of PLN 4,000–6,000 and 6,000–8,000, the respondents most frequently indicated the option of three trips per year. In these and subsequent income brackets declarations were made of more numerous trips: five, six or even seven trips per year.

It is probably no surprise that the highest percentage of people declaring seven trips per year is attributable to those with the highest income (more than PLN 10,000 per month).

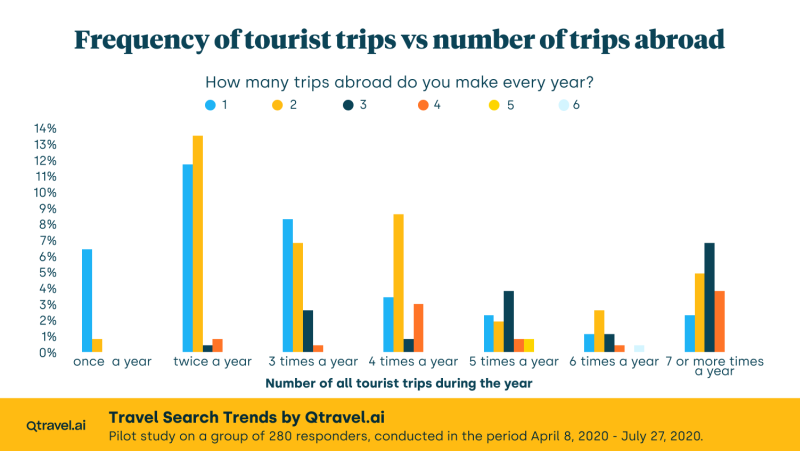

The number of tourist trips taken per year is usually also related to the interest in travelling abroad: the more times one travels, the more often one travels abroad (at least half of the trips). It may come as a surprise, however, that among people declaring only one tourist trip per year, more than 90% declare that it is a trip abroad (see Figure 4).

What relationship can be observed between the number of tourist trips undertaken annually and the decision to travel in Poland?

The cross data in Table 1 indicate that among people who undertake 1 or 2 trips per year there are single cases of respondents who do not travel in Poland at all, but the majority of respondents undertake trips to visit friends and relatives – this reason is indicated both by people who travel very often (7 or more trips per year) and relatively rarely (2 or 3 trips per year). An important reason for tourist stay in Poland is the desire to spend time with the family – this reason is indicated in particular by the people who take 2, 3 or 4 trips per year, but also by those who take the greatest number of trips per year (7 and more).

Respondents most often decide to take domestic trips when they plan a short rest – it is understandable, because then the time and organizational costs connected with long trips simply do not pay off. Two thirds of the respondents in such a case will choose to stay in Poland, regardless of how many trips they take annually in total.

The decision to stay in one’s home country may also be related to the reluctance to travel by air, in particular due to burdensome airport check-ins, although only a few respondents indicated this as a reason. A slightly higher number of people pointed to the issue of safety, considering a holiday spent in one’s homecountry to be less risky than going abroad.

In each group of respondents – regardless of the declared number of tourist trips undertaken annually – a significant proportion of people emphasized that travelling in Poland is simply attractive (response ‘I like discovering Poland’). This is an important observation from the point of view of tourism organizers and agents who have been focusing for years mainly on the offers of trips abroad. However, if Poles travel in Poland, they usually organize trips on their own. The offer of package holidays rarely appeared in agency sales or on the websites of accommodation facilities that organize stays supplemented with various forms of entertainment for children, recreational, or sports attractions, workshops, plein-air painting or photography workshops, etc. Perhaps the pandemic period will slightly change the image of the Polish tourism market: local and regional tourist organisations have for years been ready to compose the so-called network tourist offers (packages that include the offer of various entities on the local market) – but tour operators were more willing to focus on high-margin foreign packages. Restrictions on international mobility related to the pandemic have forced a slightly greater interest in the offer of Polish tourism providers – professional package offer will probably have to wait, but the indications of respondents in Table 1 provide a strong argument that the organisation of tourist stays in Poland addressed to Poles can arouse interest.

As mentioned in the introduction, the level of tourism expenditure depends not only on the number of trips taken annually, but also on their length. Therefore, in the following parts of the analysis we will take a closer look at the length and purpose of Poles’ travels.

We encourage you to read the rest of the articles in this series:

- Part 1: Profile of the respondents.

- Part 2: How often do tourists travel during the year?

- Part 3: Do we like long holiday stays in Poland?

- Part 4: Poles travelling abroad part 1.

- Part 5: Poles travelling abroad part 2.

- Part 6: How far in advance do we plan tourist trips?

- Part 7: How far in advance do we plan tourist trips? – the income factor.

- Part 8: Flexibility in holiday travel planning.

- Part 9: Frequency of travel versus flexibility in travel planning.

- Part 10: Gender versus flexibility in travel planning.